Email subscriber goal setting for B2C publishers

Here’s the data point that got every B2C publisher’s attention around the turn of the year: Google referral traffic dropped roughly 38% YOY in November, 2025. For publishers who built a business based on search, that was not a dip — it was a structural shift in the model.

Today, publishers use three new metrics to measure search independence, whether forced by catastrophic traffic drops or attained by sustained building of the owned audience:

- Email subscribers as a percentage market size

- Direct traffic as a percentage of total web traffic

- Email as a percentage of unique visitors

The most important of these is email subscribers as a percentage of market size.

So what should the market penetration be?

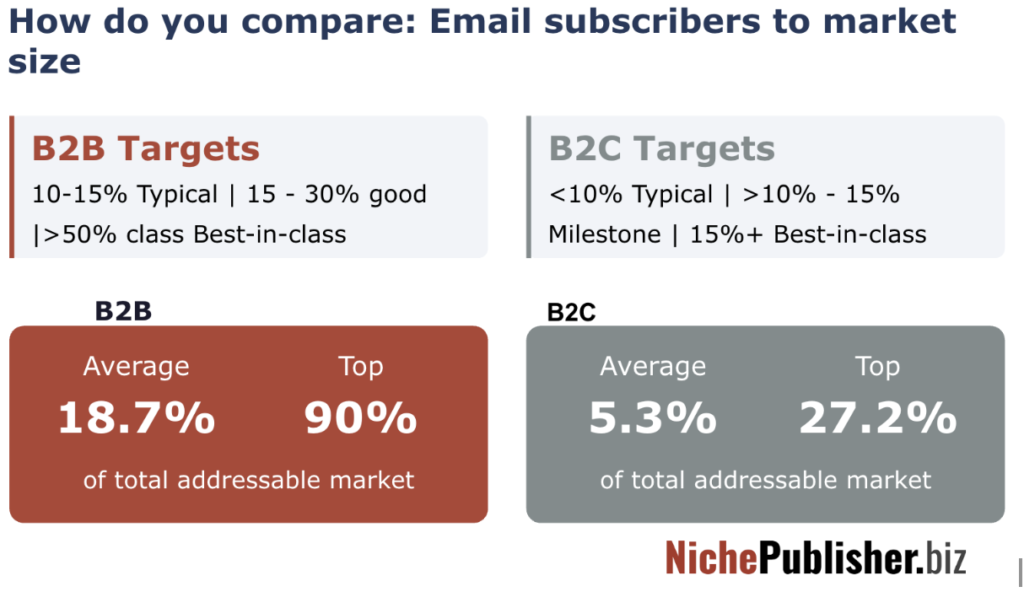

If you’re a B2C niche publisher comparing your email penetration numbers to B2B benchmarks in the 2026 email survey, you may be measuring the wrong thing.

B2C numbers look very different.

Only a few local magazines matched B2B market penetration averages, while national verticals had a much lower percentage of email to market size penetration. These low rates often mask much larger absolute opportunities.

The difference is that B2B publishers can realistically “own” a niche. The markets are defined, the audience is identifiable, and a dominant player can capture a significant share.

B2C doesn’t work that way. The markets are larger, the substitutes are everywhere (social platforms, influencers, YouTube), and the audience defines itself — you don’t get to define it for them.

That’s why B2C benchmarks often look “low” on paper, even when the business fundamentals are strong.

A 2% email penetration rate in a B2C vertical isn’t a failure. Depending on the market, it may be a category authority.

So how should B2C publishers set their email growth targets in 2026?

1. Start by defining the addressable market

There are three basic types of B2C markets: City/regional (Omaha Magazine), National Passions (Pickleball Today, HealtheCooks), and a Combination of both (Ocala Horseman, Florida Farmer).

A. The city/regional audience

City and regional magazines, aided by years of email-producing best of contests, had the most impressive email market penetration numbers of the B2C group.

Local and regional B2C magazines appeal to different interests, with a market bounded by geography. The goal isn’t national scale — it’s critical mass.

Critical mass is reached when enough of the local population has interacted with your brand that it is widely known, routinely referenced, and commercially unavoidable. The size of the email list is key evidence that this has been achieved.

In our sample, the inflection point appeared around 10% email penetration for the metro, and 2 to 7% for the DMA. Be strategically clear about which one is more important. F

or high-end magazines, a home ownership or income criterion may also apply as filters to create a more realistic number, and one that advertisers are interested in.

Here’s how to read email penetration of the local city/metro across all types of B2C publishers:

- Below 7% — Typical, with significant headroom.

- 7–10% — Brand becomes widely known.

- 10–15% — Strong local leader.

- 15%+ — Market-defining.

- 20%+ — Exceptional (small markets only).

Most local B2C publishers in our survey reported below 7% penetration. Five city, regional, and local parenting publishers exceeded 10%. One parenting publisher in a small market by combining a life-stage title with a geographic area, reached roughly 50%. Local dominance is achievable without massive scale.

B. National passion verticals

For national passions like pickleball or snowboarding, throw the local playbook out. These markets are more difficult to assess, and the goal is not critical mass but finding people who share a strong affinity to the magazine’s brand, not location, and not just everyone who occasionally engages with the topics covered.

National verticals often represent a meaningful lifestyle choice or identity.

For a sewing publisher, that’s not everyone who has ever threaded a needle, but the top 1–2% of highly engaged enthusiasts — the ones who buy the most supplies, attend events, subscribe to content, and identify themselves as sewers. Creating a persona helps; this can include age, sex, education, or other factors that can help filter the market in ways that produce a more realistic number.

Not All Passion Verticals Are the Same

To make things more complicated, within national B2C publishing, there are several structural types, and each supports different penetration ceilings.

Practice-based verticals like Quilting Arts or Fine Woodworking have the highest penetration potential. The addressable market is active practitioners — a smaller but tightly defined group with high email opt-in rates. These markets support penetration ceilings up to 10%.

Life-stage verticals like What to Expect deliver strong relevance at specific moments, such as getting married or having a baby. Email is highly valued when timed correctly, and segment-level penetration matters more than total market penetration. These can reach a 5% to 8% marker as well, but the buyer intent is well understood by advertisers, and the sheer size of the markets also counts; they punch above their weight class.

Parents Canada has a <1% share of the 1 million or so households with children in the country. However, the massive 76,000 email list supports content marketing sales to national brands, starting at $7900, going up to $40,000. A .5% gain in penetration is another 50,000 emails.

Identity-based verticals like VegNews, with strong values alignment, have a lower penetration percentage ceiling of 5%, but mask subscriber value.

Only lower market penetration ceilings are available to Spectator-based verticals like Powder Magazine. Think of fans and viewers, not participants, and larger, more casually connected audiences.

Consumption-driven verticals like Bon Appétit or Allure monetize influence, not ownership. Passion is expressed through purchasing and discovery. There are also Aspirational verticals like Mindbodygreen, but they have high churn and phase-based engagement.

The takeaway: Before you set a penetration goal, keep these factors in mind as a way to “handicap” the share your media could realistically reach. A 3% penetration rate means something very different for a practice-based quilting publisher releasing new patterns monthly and no competitors, than to a spectator sports brand in a crowded market.

Start by applying these market penetration benchmarks to your addressable market as a national passion-based publisher:

- Below 1% — Normal. You’re in the game.

- 1–2% — Strong niche position. You’re being noticed.

- 2–5% — Category authority. Advertisers are paying attention.

- 5%+ — Rare, market-leading territory.

2. Setting 2026 Goals

The question every B2C publisher should be asking right now is not “How big is our list?” It’s “How much of our addressable market do we want to own?”

You’ve already worked on the first two steps:

Step 1: Define the addressable market. Are you local or national? If local DMA or Metro? Are there age or income filters? Is the media practice-based, spectator, identity-driven, consumption-focused, aspirational, or life-stage? Are there filters to apply that could make these numbers more realistic? GPT is a great starting point to find sources for numbers you may not find on your own.

Step 2: Calculate current penetration. Divide your email subscribers by your addressable market. That percentage is the number that matters.

Step 3 is to set a penetration target based on your vertical type. Here are our recommendations:

Local and Regional Publishers: Go for Critical Mass First, Then Push to 20%

If you’re a local publisher, the first and most important goal is reaching critical mass — roughly 10% email penetration of the geographic market and demographic target. That’s the inflection point where the brand becomes self-reinforcing: residents recognize you, advertisers assume relevance, and growth starts compounding through word of mouth and direct traffic instead of paid acquisition.

Everything before 10% is building toward that moment. Everything after it gets easier.

Once you’ve crossed that threshold, the next stage is pushing toward 20% penetration over several years. This is where you move from “strong local brand” to market-defining. At 15–20%, you’re not just known — you’re unavoidable. Advertiser conversations shift from “should we be in this?” to “how can we get in?” Event fills become predictable. Sponsorship renewals become routine.

The timeline matters here. This isn’t a one-year sprint. For most local publishers, the path from 7% to 10% might take a year of focused effort. Moving from 10% to 15% might take another two. Getting to 20% is a multi-year build — but each stage unlocks meaningfully more revenue and market leverage.

National B2C Publishers: Get to 10,000 Subscribers, Then Grow by Percentage Points

For national passion-based publishers, the first milestone isn’t a penetration percentage — it’s a raw number. Get to 10,000 email subscribers.

That’s the threshold where newsletter economics start working: enough inventory to sell meaningful sponsorships, enough data to understand your audience, enough scale to prove the model. Below 10,000, you’re still building the foundation.

Once you’re past that baseline, the game shifts to penetration. Define your addressable market honestly, calculate where you stand, and then target gains of roughly 1 percentage point per year.

That may sound modest. It isn’t. In large national markets, 1 percentage point can represent tens of thousands of new subscribers and a meaningful jump in ad inventory. And the math compounds — a publisher starting at 2% penetration who gains 1 point per year reaches category authority (5%+) in three to four years and market-leading territory around 10% in six to ten years, depending on vertical type.

It takes time – think in years, and not every category supports 10%. Spectator and consumption-driven verticals may top out well below that. But for practice-based, identity-based, and life-stage verticals, that may be a realistic long-term ceiling — and one that changes the economics of the business at every stage along the way.

The Bottom Line

The opportunity is clear. National passion-based verticals win through scale and audience quality. Local publishers win by reaching critical mass and becoming known, recognized names in their niche. In both cases, email is the anchor — the clearest signal of audience ownership, monetization potential, and long-term resilience.

That’s where the real growth is.